Choose your best broker

Understanding Online Brokers in Malaysia

| Asset Class | Typical Commission | Min. Investment | Risk Level |

| Stocks | 0.1% – 0.5% | RM100 – RM1,000 | High |

| Bonds | 0.2% – 1% | RM1,000 – RM10,000 | Low-Medium |

| ETFs | 0% – 0.3% | RM100 – RM500 | Medium |

| Forex | Spread-based | RM500 – RM2,000 | High |

Evaluating Trading Fees and Commissions

When choosing a broker in Malaysia, carefully examine the fee structure. Many brokers now offer commission-free trading on stocks and ETFs, but other charges may apply. Compare the costs for different transaction types, including options trades, mutual fund purchases, and foreign exchange fees. Some brokers charge inactivity fees or account maintenance fees, which can impact your overall costs. Look for brokers that provide transparent pricing without hidden fees. Consider the total cost of trading, including currency conversion fees for international trades. Some Malaysian brokers offer tiered pricing models, reducing fees for higher trading volumes.

Understanding Fee Structures

- Flat-fee per trade

- Percentage-based commissions

- Tiered pricing models

- Zero-commission trades

Assessing Market Access and Investment Products

The range of available markets and investment products is a critical factor when selecting a broker in Malaysia. Ensure the broker provides access to the specific markets you’re interested in, such as Bursa Malaysia, US stocks, or other international exchanges. Check the variety of investment products offered, including stocks, bonds, ETFs, mutual funds, and derivatives. Some brokers specialize in certain asset classes or markets, while others offer a more comprehensive selection. Consider whether the broker provides access to initial public offerings (IPOs) or other specialized investment opportunities. Evaluate the broker’s offering of Malaysian and international ETFs, which can be useful for diversification.

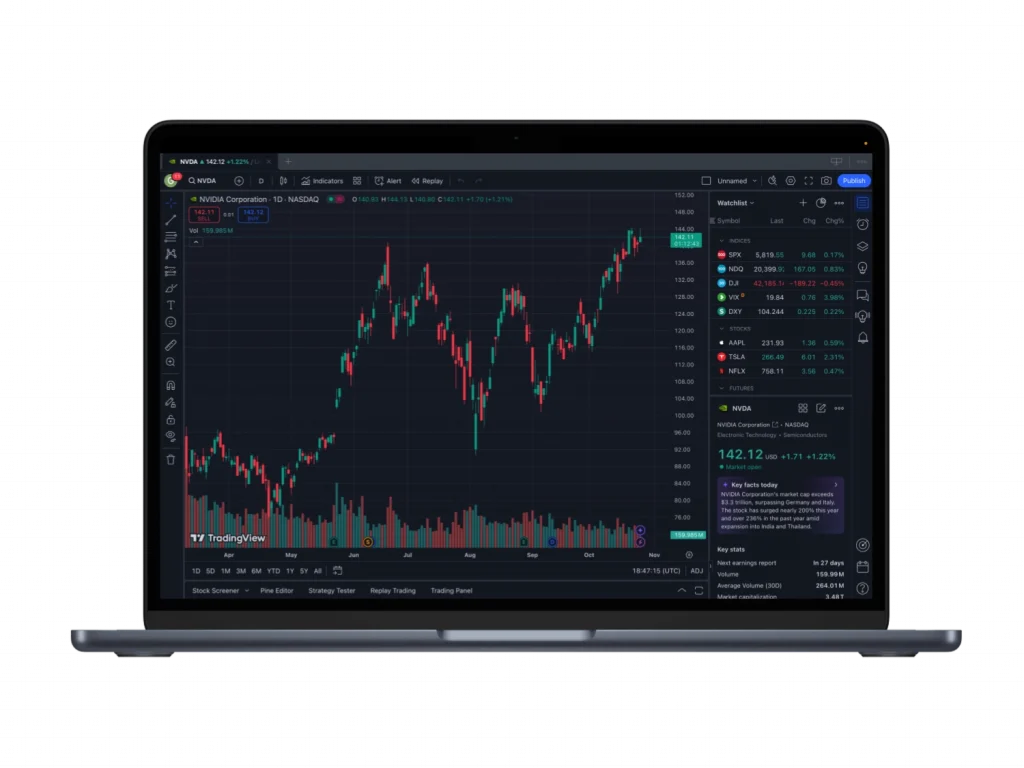

Examining Trading Platforms and Technology

The quality and features of a broker’s trading platform can significantly impact your trading experience. Assess the user-friendliness of the platform, especially if you’re a beginner. Look for brokers that offer both web-based and mobile trading applications. Advanced traders should evaluate the availability of technical analysis tools, real-time market data, and customizable charting options. Consider the speed and reliability of trade execution, particularly if you plan on active trading. Some Malaysian brokers provide demo accounts, allowing you to test their platforms before committing real funds.

Key Platform Features to Consider

- Charting tools and technical indicators

- Real-time market data and news feeds

- Order types and execution speed

- Mobile app functionality

Evaluating Research and Educational Resources

Quality research and educational materials can be valuable, especially for newer investors in Malaysia. Compare the research offerings of different brokers, including company reports, market analysis, and economic insights. Look for brokers that provide educational resources such as webinars, tutorials, and investment guides. Some brokers offer paper trading or virtual portfolios, allowing you to practice trading strategies without risk. Consider whether the broker provides research and analysis specific to the Malaysian market, as well as global market perspectives.

| Educational Resources | Beginner | Intermediate | Advanced |

| Basic Terminology | Essential | Useful | Optional |

| Technical Analysis | Optional | Essential | Advanced |

| Fundamental Analysis | Useful | Essential | Advanced |

| Risk Management | Essential | Essential | Essential |

Assessing Customer Support and Service

Reliable customer support is crucial when choosing a broker in Malaysia. Evaluate the availability of support channels, including phone, email, and live chat. Check the operating hours of customer service, especially if you plan on trading outside regular Malaysian business hours. Consider the quality of support for technical issues and trading inquiries. Some brokers offer dedicated account managers for high-volume traders or premium account holders. Read user reviews and testimonials to gauge the responsiveness and effectiveness of a broker’s customer support team.

Customer Support Considerations

- Availability of local language support

- Response times for inquiries

- Quality of technical support

- Availability of in-person support at local branches

Considering Account Types and Features

Different brokers in Malaysia offer various account types to cater to diverse investor needs. Evaluate the available account options, such as individual, joint, or corporate accounts. Check if the broker provides Islamic trading accounts that comply with Shariah principles. Consider the minimum deposit requirements for different account tiers. Some brokers offer additional features like margin trading or short selling, which may be relevant for more advanced traders. Assess whether the broker provides retirement account options or other specialized accounts that align with your financial goals.

Evaluating Regulatory Compliance and Security

Ensure that any broker you consider in Malaysia is properly regulated by the Securities Commission Malaysia (SC). Verify the broker’s licensing and registration status on the SC’s website. Assess the security measures implemented by the broker, including encryption protocols and two-factor authentication. Check if the broker participates in any investor protection schemes. Consider the broker’s track record and reputation in the Malaysian market. Evaluate the broker’s policies on fund segregation and protection of client assets.

Key Security Features

- Data encryption standards

- Two-factor authentication

- Regular security audits

- Insurance coverage for client funds

Comparing Additional Services and Features

Beyond basic trading functionality, consider additional services offered by brokers in Malaysia. Some brokers provide integrated banking services, allowing for seamless fund transfers. Evaluate the availability of features like dividend reinvestment plans or automatic investing options. Check if the broker offers access to international markets and multi-currency accounts. Consider whether the broker provides tools for portfolio analysis and performance tracking. Some brokers offer additional perks like free real-time data for certain markets or access to premium research reports.

| Market | Trading Hours (MYT) | Lunch Break | Notable Indices |

| Malaysia | 09:00 – 17:00 | 12:30 – 14:30 | KLCI, FBM EMAS |

| Singapore | 09:00 – 17:00 | 12:00 – 13:00 | STI, FTSE ST |

| Hong Kong | 09:30 – 16:00 | 12:00 – 13:00 | Hang Seng |

| United States | 21:30 – 04:00 | No lunch break | S&P 500, Dow Jones |

FAQ:

The minimum deposit varies among brokers in Malaysia. Some brokers allow you to open an account with no minimum deposit, while others may require initial deposits ranging from RM500 to RM1,000 or more.

Many Malaysian brokers offer access to international markets, including US, Hong Kong, and Singapore stocks. However, the range of available markets can vary between brokers, so it's important to check their offerings.

Yes, several brokers in Malaysia offer Islamic trading accounts that comply with Shariah principles. These accounts typically avoid interest-based transactions and adhere to specific trading guidelines.