Top Dividend Stocks To Buy For May 2025

Ultimate guide to trading and brokerage in Malaysia

Top Dividend Stocks To Buy For May 2025

The investment landscape of 2025 presents unique challenges and opportunities for income-focused investors. Market volatility has intensified due to geopolitical tensions and trade disputes. Dividend stocks have emerged as strategic assets for capital preservation and income generation. Many institutional investors are increasing allocations to dividend-paying equities. Malaysian markets reflect these global trends with regional nuances affecting performance metrics.

Market Conditions Driving Dividend Stock Demand

Current market volatility affects both equity and fixed-income sectors simultaneously. Trade tensions have created unpredictable price movements across major indices. Dividend-paying companies provide defensive positioning during uncertain economic periods. The correlation between dividend stocks and market volatility remains negative in most scenarios. Malaysian investors face additional considerations related to currency fluctuations and regional economic factors.

| Market Factor | Impact on Dividend Stocks | Investor Implication |

| Interest Rate Environment | Moderate pressure on yields | Selective opportunities in sectors with pricing power |

| Trade Disputes | Supply chain disruptions | Focus on companies with domestic revenue streams |

| Currency Fluctuations | Affects international holdings | Balance domestic and foreign dividend sources |

| Inflation Trends | Potential dividend growth catalyst | Prioritize companies with pricing flexibility |

| Credit Market Conditions | Cost of capital considerations | Analyze balance sheet strength carefully |

Energy Sector Leaders for Income Generation

The energy sector maintains attractive dividend metrics despite market turbulence. Distribution networks operate with regulated returns supporting payment sustainability. Infrastructure assets provide predictable cash flows regardless of commodity price fluctuations. Long-term contracts stabilize revenue projections even during economic downturns. Storage facilities generate fees independent of energy price movements.

ExxonMobil (XOM) Analysis

ExxonMobil represents a standout dividend aristocrat with 25+ consecutive years of payment increases. The company maintains focus on core operations rather than diversifying into alternative energy. Capital expenditure plans support production growth through 2028. Cash flow metrics indicate dividend coverage ratio of 1.8x expected payments. Balance sheet strength allows continued distribution increases despite industry headwinds.

Oneok (OKE) Value Proposition

Oneok presents compelling valuation trading 19% below calculated fair value estimates. Recent strategic acquisitions strengthen competitive positioning in key markets. Management projects dividend increases of 4-6% annually through 2026. Quarterly distribution structure provides regular income streams for retirement portfolios. Midstream operations reduce direct exposure to commodity price volatility.

Consumer Staples With Sustainable Payouts

Consumer staples companies offer defensive characteristics with recession-resistant revenue models. Product portfolios include essential items with inelastic demand patterns. Brand strength enables pricing power during inflationary periods. Distribution networks provide competitive advantages against market entrants. Cash conversion cycles support regular dividend payments throughout economic cycles.

- Established consumer brands with decades of operating history

- Recession-resistant product categories with consistent demand

- Strong pricing power protecting margins during inflationary periods

- Global distribution networks reducing regional economic risks

- Significant cash reserves supporting dividend sustainability

Altria Group (MO) Dividend Profile

Altria maintains dividend yields approximately five times the S&P 500 average. Share price appreciation exceeded 30% over the trailing twelve months. Tariff-resistant business model protects revenue streams during trade disputes. Profitability metrics show improvement despite volume challenges in core categories. Management prioritizes shareholder returns through structured capital allocation policies.

Healthcare Sector Income Opportunities

Healthcare companies combine defensive characteristics with demographic growth tailwinds. Aging populations drive increased utilization across service categories. Regulatory frameworks provide stability for reimbursement models. Patent protection creates temporary monopolies for pharmaceutical products. Medical technology advances open new revenue streams with margin expansion potential.

CVS Health (CVS) Financial Overview

CVS Health demonstrated exceptional performance with 52.4% share price growth during Q1 2025. Current trading levels represent 21% discount to calculated fair value estimates. Forward dividend yield reaches 3.93% with annual payments of $2.66 per share. Integrated healthcare model connects pharmacy benefits, retail locations, and clinical services. Acquisition strategy strengthens competitive positioning across multiple healthcare segments.

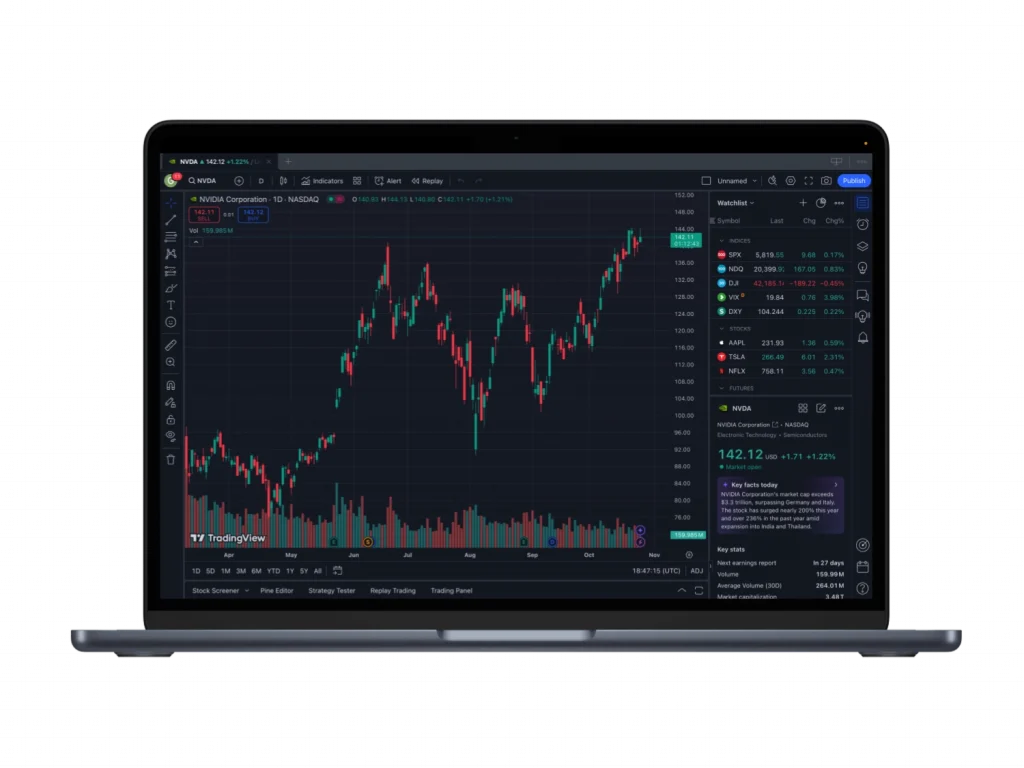

Technology Sector Dividend Growth Potential

Technology companies increasingly return capital to shareholders through dividends. Mature tech firms generate substantial free cash flow from established product lines. Software-as-a-service models provide recurring revenue supporting distribution stability. Hardware manufacturers with specialized capabilities maintain pricing power. Patent portfolios create competitive moats protecting profit margins.

Corning (GLW) Technical Analysis

| Technology Dividend Stock | Forward Yield | Annual Payment | 5-Year Dividend CAGR | Payout Ratio | Earnings Growth |

| Corning (GLW) | 2.3% | $1.12 | 8.7% | 48% | 6.5% |

| Cisco Systems (CSCO) | 3.1% | $1.56 | 5.9% | 52% | 4.2% |

| International Business Machines (IBM) | 3.8% | $6.64 | 3.2% | 65% | 3.9% |

| Texas Instruments (TXN) | 2.7% | $5.20 | 12.8% | 58% | 7.1% |

| Broadcom (AVGO) | 1.9% | $21.00 | 15.6% | 42% | 11.3% |

Financial Services With Attractive Yields

Financial institutions benefit from rising interest rate environments. Net interest margins expand during monetary tightening cycles. Loan portfolios generate predictable income streams supporting dividend payments. Fee-based services provide diversification beyond interest revenue. Capital requirement regulations ensure balance sheet stability during economic fluctuations.

Business Development Companies (BDCs)

Business Development Companies represent specialized financial firms with exceptional dividend characteristics. These entities provide financing to middle-market businesses through structured transactions. Regulatory frameworks require substantial dividend distributions to maintain tax advantages. Portfolio diversification reduces impact from individual borrower defaults. Quarterly payment structures deliver consistent income for shareholders.

Ares Capital (ARCC) Fundamental Strengths

Ares Capital offers specialized financing solutions with dividend yields reaching 9.1%. Analyst recommendations include “buy” ratings from major research firms including RBC Capital. Management demonstrates discipline in credit underwriting during challenging economic periods. Portfolio construction focuses on first-lien secured positions reducing default risk. Scale advantages provide access to attractive investment opportunities unavailable to smaller competitors.

Utility Companies For Stable Income Generation

Utility operations deliver essential services with regulated return structures. Revenue models remain largely insulated from economic cycles. Regulatory frameworks ensure reasonable profit margins while controlling consumer costs. Capital-intensive infrastructure creates barriers to competitive entry. Long-term planning horizons match well with dividend investment strategies.

Exelon (EXC) Performance Metrics

Exelon demonstrated remarkable performance with 23.5% price appreciation in Q1 2025. Forward dividend yield reaches 3.47% with annual distributions of $1.60 per share. Regulated electric operations span multiple jurisdictions diversifying regulatory risk. Nuclear generation assets provide zero-carbon electricity meeting environmental mandates. Transmission infrastructure investments support future growth initiatives with regulatory support.

ETF Strategies For Dividend Investors

| ETF Category | Representative Fund | Assets Under Management | Expense Ratio | Forward Yield | Holdings Count |

| Large-Cap Dividend | Schwab U.S. Dividend Equity ETF | $65 billion | 0.06% | 3.4% | 104 |

| High Yield Focus | Vanguard High Dividend Yield ETF | $54 billion | 0.08% | 3.7% | 448 |

| Dividend Growth | Vanguard Dividend Appreciation ETF | $48 billion | 0.06% | 2.2% | 317 |

| Active Management | T. Rowe Dividend Growth ETF | $700 million | 0.50% | 2.8% | 85 |

| International Dividend | iShares International Select Dividend ETF | $3.8 billion | 0.49% | 5.2% | 92 |

Risk Assessment Methodology For Dividend Investments

Dividend sustainability requires comprehensive analysis beyond current yield figures. Payout ratios measure the percentage of earnings distributed to shareholders. Free cash flow coverage provides insight into distribution sustainability during economic stress. Historical payment patterns indicate management commitment to shareholder returns. Competitive positioning affects long-term earnings power supporting future increases.

- Dividend payout ratio evaluation (target range: 30-60% for most sectors)

- Free cash flow coverage analysis (minimum 1.5x coverage preferred)

- Historical dividend growth consistency assessment

- Competitive advantage sustainability evaluation

- Sector-specific risk factor identification and mitigation

Conclusion And Strategic Implementation

Dividend stocks represent strategic portfolio components for May 2025 investment allocations. They provide income stability during volatile market conditions while maintaining appreciation potential. Quality metrics remain more important than maximum current yield for long-term performance. Sector diversification improves risk-adjusted returns through economic cycles. Regular portfolio rebalancing optimizes income generation while managing risk parameters.

FAQ:

Sustainable dividend stocks combine reasonable payout ratios under 60% with consistent free cash flow generation. They demonstrate competitive advantages protecting profit margins from erosion. Management teams prioritize shareholder returns through defined capital allocation policies. Balance sheet strength provides flexibility during economic challenges. Historical payment patterns show commitment to maintaining distributions during difficult periods.

Interest rate increases typically pressure dividend stock valuations initially through discount rate effects. Financial sector dividends often benefit from higher rates through expanded net interest margins. Utilities and REITs generally face more significant headwinds during rate hike cycles. Companies with pricing power can offset higher capital costs through revenue adjustments. Dividend growth rates become increasingly important during rising rate environments to maintain real returns.

The optimal approach balances current yield with future growth potential based on individual financial objectives. Retirement portfolios often emphasize current income requiring higher initial yields. Accumulation-phase investors typically benefit from lower yields with accelerated growth rates. Total return analysis combines both components for comprehensive evaluation. Sector-specific considerations affect the relative importance of each factor. Tax efficiency implications differ between high-yield and growth-oriented dividend strategies.